Judging whether performance is good or bad can be absolute - do we have more money than we did last year? - or relative - have we done better than some benchmark like "the market"? Both might be relevant. The absolute measure is useful for seeing how close we are to a goal while the relative tells us whether we are doing a good job managing investments.

Absolute performance

If we only have only have investment account and neither contributed nor withdrew cash during the year, then the calculation of investment performance is dead simple - take the end of December 2011 and 2012 account statement balances and see what the percentage or dollar difference is. Then subtract inflation, which is probably going to end up being about 1% for the year (check the CPI for December on the Bank of Canada website here when it comes out sometime in January), to see the net gain in real spending power.

Unfortunately, most investors face two calculation complications - 1) multiple accounts like RRSPs, TFSAs, RRIFs, RESPs, LIRAs, taxable accounts and 2) cash flow contributions going in or withdrawals coming out of accounts. Arriving at a representative rate of return considering the timing and size of such cash flows can be tricky. Online brokers will usually show you a return for each account but not across multiple accounts.

Modified Dietz is a good method - A well-accepted procedure for coming up with a performance number is the modified Dietz method, described in detail on Wikipedia. The formula looks daunting but fear not, PWL Capital's Justin Bender recently posted in PWL 2012 Rate of Return Calculator a link to a free downloadable spreadsheet that does the job. All we investors need to do is enter month end account balance totals and cash contributions or withdrawals. Bender's post even walks us through how to do it.

Relative performance

Once we have the return on our own holdings we can then compare to some benchmark. But the question arises: what is the proper benchmark? It certainly is not a fair comparison to take something like the S&P/TSX Composite Index quoted on many news websites. First, the index almost always shows only the index price level change and fails to include dividends or distributions that make up a significant portion of total returns (see our very popular post on the subject of total returns). Second, most portfolios contain more asset classes than just Canadian equities, by including such others as US, international and emerging market equities, bonds and REITs. Third, indices do not subtract management fees and other expenses that limit the practical possibilities for returns the investor faces in the real world.

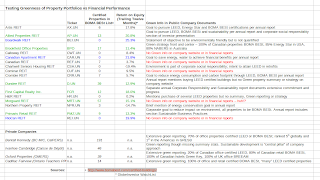

Compare with ready-made real total return portfolios - The simplest and most effective way to address all the above issues is to compare with portfolios of ETFs such as those below. Make sure that the asset classes within match as closely as possible with your own portfolio. Then pull up the performance numbers from the ETF provider website. The following portfolio ETFs contain only ETFs built with the standard cap-weighted passive index holdings that are generally accepted benchmarks of market returns. They also have the convenient advantage of converting and expressing foreign holdings and performance into Canadian dollars. The returns below from the iShares website show one-year returns up to December 27th close of business.

- iShares Growth Core Portfolio Builder Fund (TSX: XGR), containing about 70% bonds: 2012 return 9.01%

- iShares Conservative Core Portfolio Builder Fund (XCR), about 85% bonds: 2012 return 4.25%

- One-Minute Portfolio: 2012 return "nearly 6%"

Compare with the Asset Mixer - Another way to approximate returns that can align asset allocation percentages more precisely with your own portfolio is to use the Stingy Investor Asset Mixer. The Mixer lets one plug in any percentage for a broad variety of asset classes. The minor downside is that the fees/costs estimate is a round number typical of various types of fund. The year-to-year variations in returns amongst asset classes tend to overwhelm fee differences, so the closer alignment with asset class proportions is a very useful view to obtain. Stingy Investor Norm Rothery has usually updated the annual performance figures around the end of January so look for 2012 data in a month or so.

As can be seen from the above benchmark portfolio returns, there can legitimately be a wide range of 2012 returns for different portfolio structures. Getting the right numbers, both for one's own portfolio returns and for a benchmark, is essential to be able to make correct fact-based judgments and decisions for 2013 and beyond.

Disclaimer: this post is my opinion only and should not be construed as investment advice. Readers should be aware that the above comparisons are not an investment recommendation. They rest on other sources, whose accuracy is not guaranteed and the article may not interpret such results correctly. Do your homework before making any decisions and consider consulting a professional advisor.