"Everything should be made as simple as possible, but not simpler." Albert EinsteinIn a 30 May 2014 post we defined what a portfolio for a reluctant investor should do, and reviewed several alternatives that don't quite do the best job. We've updated the subsequent June 2014 post to June 2025. Happily, what we said then has been proven by eleven more years still to work fine!

................................................................................................................

This is what we propose, the Reluctant Investor's Lifelong Portfolio and Investing Plan

1) Portfolio structure: The portfolio will consist of two funds -

- iShares S&P/TSX Capped Composite Index ETF (trading under TSX symbol XIC) and

- iShares Core High Quality Canadian Bond Index ETF (symbol: XQB).

- At any time, the objective is to have half / 50% of the portfolio in each fund.

3) Initial allocation to target: Within each account, buy equal amounts of both XQB and XIC.

4) Automate investing: Set up automatic transfers to contribute to the TFSA/RRSP/taxable account if in savings mode. XQB has the wonderful feature of being part of the Pre-authorized cash contribution plan at iShares, which is free and automatic, so sign up for the amount going into XQB. Unfortunately, XIC is not part of the PACC so purchases of XIC you will have to do yourself. Leave the money going into XIC in cash until there is at least $1000 to invest. Less than a $1000 for a trade and the commissions start to add up too much and hurt investment returns.

Similarly, during retirement withdrawal when regular amounts are to come out, sign up for the Systematic withdrawal plan for XQB (also not available for XIC). You will have to sell the appropriate amount to leave approximately half each in XIC and XQB.

Note: Not all brokers participate in the PACC and SWP. Check out here the in/out listing of brokers, along with details and forms for all the plans, including the DRIP. If the broker does not do the PACC and SWP, you must carry out buy and sell transactions yourself.

Sign up for the Dividend reinvestment plan (DRIP) for both XIC and XQB. That way, the regular cash distributions will not sit idle and will get reinvested automatically and for free in XIC and XQB.

5) Rebalance: Once a year, perhaps on a birthday to remember more easily, check the latest monthly market values of XIC and XQB holdings totalled across all accounts. If either is more than 5% away from the target 50%, sell the excess amount of the greater value ETF and buy that amount of the lesser. If less than $1000 is at stake to be re-allocated, don't bother, the cost of trading commissions is not worth it.

In the same manner, any large lump sum contributions or withdrawals can be used to even up the 50% allocation to each ETF.

............................................................................................

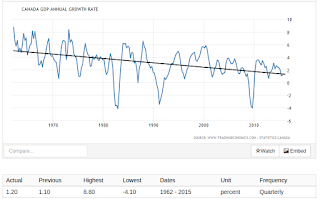

Historical Performance - To see what kind of performance the Reluctant Investor Portfolio would have provided, we again turn to the Stingy Investor Asset Mixer tool. XIC's performance matches exactly with the tool's TSX Composite, while XQB lines up fairly well with All Canadian Bonds. (Note: Stingy Investor has a model portfolio it calls the Simply Canadian ETF Portfolio which has almost the same composition as our Reluctant Investor, i.e. we did not invent the idea but we are promoting it with a different name to emphasize its potential usefulness.)

From 1980 to 2024 inclusive, our portfolio performed quite well. Compared to more complicated and sophisticated alternatives, the portfolio trades off some performance and some volatility to gain simplicity and convenience.

For a retiree withdrawing 4% a year the worst down year was 2008, when it incurred a 17% loss. The portfolio had fully recovered its loss within two years. Over the whole 45 year time span, despite constant yearly withdrawals, the portfolio gained an average of 4.2% compounded per year and it never dropped below its retirement start date value despite a number of down years (12 out of 45).

For a saver, the fact of making no withdrawals reduces the worst 2008 down to only 13% and there were only 9 down years in total. Recovery from down years never took longer than two years. The compound return was a healthy 9% a year.

Unfortunately the Stingy Investor tool does not include inflation data before 1980, so the period of high inflation, and its effects on real after-inflation returns, which is what really matters, cannot be examined. From 1980 to 2024, the real return of the Reluctant Investor Portfolio was 5.7% compounded during the savings no-withdrawal phase, with only 10 years out of 45 showing a decline that never took longer than two years till recovery from a decline. When the added stress on the portfolio of a 4% annual withdrawal was included, the portfolio still managed an average gain of 1.5% annually, but had 15 down years, and a decline of 22.2% starting in 2008 that still has not been recaptured.

Thus, though there is no absolute assurance of never taking a loss by selling out at any time we believe the Reluctant Investor's Lifelong Portfolio is a pretty good balance of the objectives. Overall, we believe the solution works pretty well, delivering 80% or more of the benefits of more time-consuming and complicated investing.

Such a portfolio has value. Not everyone can, or should be, an investor who spends time and effort on investing. That's why our post's title says the portfolio is both inspired by, and intended for, someone like Albert Einstein. After all, could anyone think that Einstein, or the world, would have been better off, if he had applied his time to investing at the expense of physics?

Disclaimer: This post is my opinion only and should not be construed as investment advice. Readers should be aware that the above comparisons are not an investment recommendation. They rest on other sources, whose accuracy is not guaranteed and the article may not interpret such results correctly. Do your homework before making any decisions and consider consulting a professional advisor.