A mortgage is like a negative bond

A mortgage is a large debt. In the investment context, a mortgage works the opposite of a bond. Instead of being an asset like a bond that pays you interest, it is a liability with interest and principal that you must pay.

A mortgage on a home has no income tax consequences. The borrowing costs are after-tax, the costs are not tax deductible and there is no capital gains tax to pay on your home (providing of course that it qualifies as your principal residence - see the Canada Revenue Agency rules) when you sell it.

The home is also an asset with a market value. For most people, the value of their home and the size of the mortgage are very significant in their overall financial picture, as we see in the example below.

Example

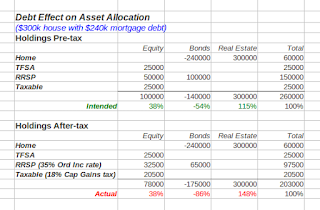

- Home valued at $300,000 and a mortgage of $240,000. This is the new maximum 80% loan-to-value ratio for refinancing instituted in July 2012, when the federal government issued more restrictive rules to cool Canada's housing market.

- Financial assets are $200,000 (pre-tax), half in equities, half in bonds across taxable, TFSA and RRSP accounts, as in last week's post.

In our example, the home dominates the investor's total asset allocation. The investor's wealth is very concentrated in that one asset. There is a significant amount of leverage, as indicated by the large negative (-86% after-tax) in the bonds column.

Leverage entails risk and no one wants to lose their home. A critical question therefore is whether the mortgage payments can be maintained. Different people can have markedly different risk depending on their job security.

Invest in mortgage or RRSP?

Thinking of a home within the investment asset allocation raises the oft-asked question of whether to put extra cash towards paying down the mortgage or contributing to an RRSP or TFSA. The simple answer, as TaxTips.ca shows here, is to pick the one that has the highest return (TFSA or RRSP) or interest rate (mortgage). York University professor Moshe Milevsky elaborates on the logic in this article from the International Finance and Insurance Decisions Center.

Home is not an investment asset exactly like stocks and bonds

Milevsky (here in the Globe and Mail and in several videos on his website) and others such as financial advisor and author Larry Swedroe (here on CBS News) say a home is as much consumption as investment due to all the maintenance costs and property taxes and the modest long term returns (see blogger Preet Banerjee's post with stats up to 2008 and Milevsky's Houset Allocation with stats up to 2004). A house also differs in that it is one big indivisible lumpy holding. As a result the usual investment allocation fix of re-balancing cannot work. Later in life, when the mortgage has been paid off and other savings have built up, the mix of assets will not look nearly so lop-sided - e.g. this example where there is no mortgage and pre-tax financial assets have doubled.

One aspect of houses generally benefits the investor - house prices over the long term have a low correlation with the stock market (Milevsky's Houset article contains a table of correlations of real estate in various Canadian localities with the Canadian TSX and the US S&P 500), which means that prices follow a different pattern of ups and downs and when the stock market tanks, house prices don't usually follow suit. Total wealth gains greater stability.

Over the short term, there might well be high correlation and simultaneous drops, as was the case from 2008 to nowadays in the USA when housing collapsed along with the stock market. Individual circumstances can also change the real estate correlation, for example owning a house in a one industry town and owning lots of shares of that company. A perfect storm could ensue - the company runs into trouble, its stock plummets, it shuts the local plant location, you lose your job and local real estate flounders.

The same approach can be used to assess non-mortgage debt, whether it is used for investing, as we examined last year in Borrowing to Invest: When & How to Do It or simply to pay for consumption spending. The debt appears as a negative amount and if the debt buys returns-producing assets, that value shows as well.

A primary objective of asset allocation is to be aware of and to manage risk. We hope readers agree that taking the home mortgage and value into account is an important step in that process.

Disclaimer: this post is my opinion only and should not be construed as investment advice. Readers should be aware that the above comparisons are not an investment recommendation. They rest on other sources, whose accuracy is not guaranteed and the article may not interpret such results correctly. Do your homework before making any decisions and consider consulting a professional advisor.

No comments:

Post a Comment